As A Substitute of guessing what your retirement financial savings can provide, you’ll see exactly how much guaranteed lifetime income your cash can generate. This sort of annuity combines the predictable development of a tax-deferred MYGA with the safety of guaranteed lifetime withdrawals. Older folks obtain https://www.personal-accounting.org/ higher annuity payouts as a outcome of the insurance company expects to make fewer funds over a shorter interval due to shorter life expectancy. That means the same lump sum could be unfold into bigger monthly checks.

How We Earn Cash

It interprets the time worth of cash into easy-to-understand numbers. As A Substitute of running complex formulation, you scan a table to determine the present or future worth of your annuity funds. This insight might help you make better decisions about saving, investing, and retirement planning.

- Without this comparability, you threat leaving tens of 1000’s of dollars of retirement revenue on the desk.

- The longer your deferral period, the higher your eventual payout, because your cash earns interest and the insurer assumes fewer complete payout years.

- As of October 2025, with a $75,000 annuity, you’ll get a direct payment of $360 per month starting at age 60, $400 per month at age sixty five, or $430 per 30 days at age 70.

- The future value of an annuity table helps illustrate how your present investments will grow over time.

- The estimated monthly annuity payout is based in your desired quantity to speculate upfront and the assumed annual payout rate of 5.50%.

How Are Income Annuity Payouts Calculated?

For immediate annuities, today’s rate of interest instantly determines your payment amount. For deferred annuities, current charges have an effect on the expansion of your premium during the deferral period — so rising charges over time can translate into greater future payouts. But whereas annuities do come with some sizable benefits total, what you stand to gain from an annuity depends closely on the kind of annuity you choose, particularly right now. From fixed to variable to indexed options, each type of annuity comes with its personal stability of risk, reward and complexity. For instance, while some annuities promise higher returns, those usually come with publicity to market downturns or sophisticated payment constructions.

As of October 2025, with a $400,000 annuity, you’ll get a direct cost of $2,400 monthly starting at age 60, $2,643 monthly at age sixty five, or $2,850 per thirty days at age 70. As of October 2025, with a $350,000 annuity, you’ll get an immediate fee of $2,100 monthly beginning at age 60, $2,313 month-to-month at age sixty five, or $2,495 per month at age 70. As of October 2025, with a $300,000 annuity, you’ll receive an instantaneous fee of $1,800 per thirty days beginning at age 60, $1,983 per 30 days at age 65, or $2,138 per thirty days at age 70.

Insurers calculate annuity payouts partly by estimating how long they anticipate to make funds. This relies in your age and sex, which influence your projected life expectancy. And, remember to contemplate the issuer’s monetary strength and the contract phrases carefully. Rankings from companies like AM Finest can give you insight into the insurer’s ability to satisfy its obligations over time.

Readers are by no means obligated to make use of our partners’ services to entry the free assets on Annuity.org. Annuity.org is a licensed insurance coverage agency in a quantity of states, and we have two licensed insurance coverage agents on our staff. Nonetheless, we do not promote annuities or any insurance coverage products, nor can we receive compensation for selling specific products. As An Alternative, we partner with trusted professionals in the annuity business.

Enter your age, state, and premium quantity, then select when you need earnings to begin. The calculator immediately displays your annual and monthly payouts, ranked from the highest-paying insurers to the lowest. Though a onerous and fast annuity calculator could be a valuable software in understanding how these annuities work, there are some limitations to think about when using it. We are compensated once we produce respectable inquiries, and that compensation helps make Annuity.org a fair stronger resource for our viewers. We may also, at instances, promote lead data to companions in our network in order to best join shoppers to the knowledge they request.

Simply fund, analysis, trade and manage your investments on-line all conveniently within the Chase Mobile® app or at chase.com. J.P Morgan on-line investing is the simple, good and low-cost approach to make investments on-line. Morgan on-line investing options, offers, promotions and coupons. The variable annuity product depicted here just isn’t an precise variable annuity product and is hypothetical in nature solely. Morgan Private Client Advisor to arrange an annuity contract that may help impression your retirement technique. Try our growth calculator to see your fixed return earlier than you invest.

Compare your annuity options annuity calculator and find the right fit for your retirement plans. We may receive commissions from some hyperlinks to products on this web page. Get a quick breakdown of how Gainbridge® fastened annuities evaluate — and which one may be best for you. Annuity loans permit individuals to borrow in opposition to the worth of their annuity contract with out surrendering it completely.

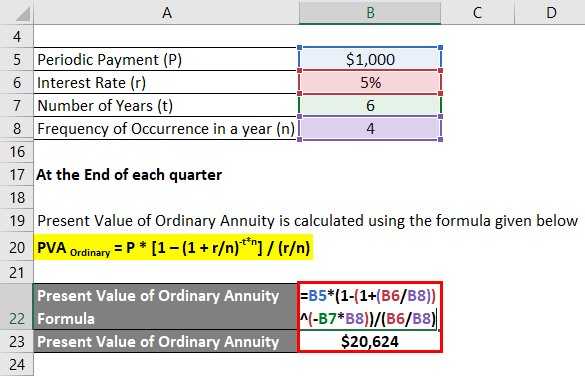

Working with a fee-based financial advisor quite than one compensated by annuity commissions can even assist ensure you’re choosing a product that genuinely aligns together with your wants. This article explores the key variations between annuities and perpetuities, outlining how each provides income over time and when every could additionally be appropriate for retirement or legacy planning. It isn’t supposed to supply, and shouldn’t be interpreted as, individualized investment, legal, or tax recommendation. For recommendation regarding your own state of affairs please contact the appropriate professional. The GainbridgeⓇ digital platform offers informational and educational assets meant just for self-directed functions. This article shows you tips on how to use an annuity desk to calculate the current worth (PV) or future worth (FV) of your annuity payments.